Accounts receivable collections system powered by the SAS analytical platform makes it possible to develop effective strategies for working with debtors and automate business processes related to debt collection. The system provides for setting up and optimizing the processes of omnichannel communications with debtors, developing predictive models of customer payment behavior and the analyzing accounts receivable (AR) portfolio by required metrics.

The implementation of a solution to optimize the AR collection fueled by machine learning methods and automation of consumer interaction is crucial to developing effective business strategy. The use of a personalized approach to work with problem consumers makes it possible to reduce overdue debts growth and advance payments. The solution also provides a reduction in the AR level without a significant expansion of the company's staff, minimizes the negative social effects of untargeted mass communications to collect AR.

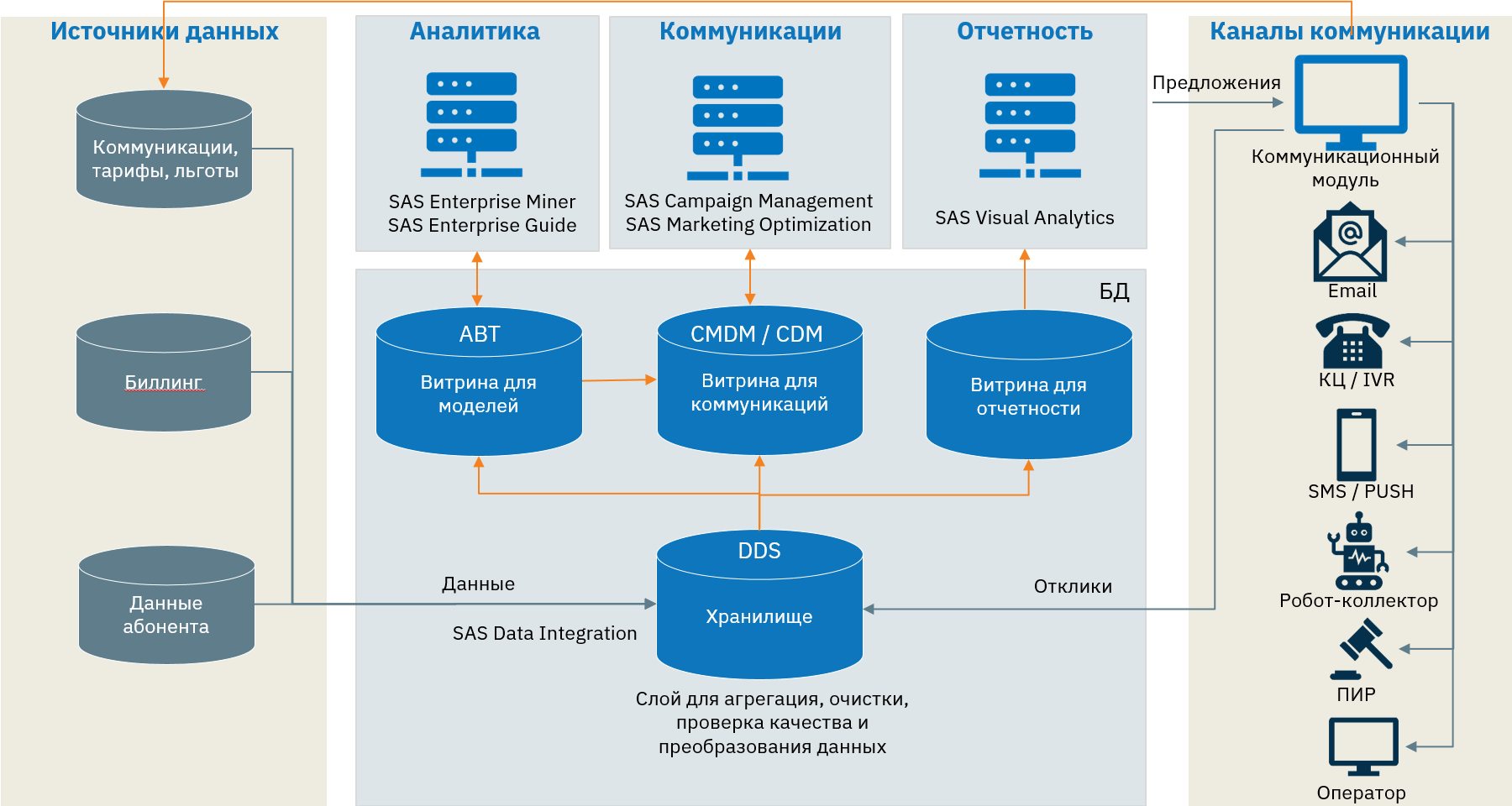

Functional architecture of the analytical system

Key features:

- Automatic formation and updating of a layer of detailed data about the client (DDS, Detail Data Store) in a single database (DB);

- Building a customer communication strategy based on a database, segmentation, predictive models and optimization:

- Using socio-demographic data and information about customer payments;

- Segmentation by depth of debt;

- Selection of the optimal conversation / text / creative script for communication with the client;

- Selection / pickup of optimal communication channels with the client;

- Model of probability of response depending on collection strategy (channel and frequency of communication, type of interaction)

- Model of predicting the probability of dialing to the client (at a certain time, day of the week etc.);

- Probability model for the occurrence of arrears;

- Models of the transition of non-debtors to the segment of debtors;

- Model of probability of debt recovery, % of debt recovery, etc.

- A wide range of client exposure pathways, administration from a single communication center by operator;

- Messengers;

- Social media;

- Mobile communication;

- SMS;

- Phone (call center);

- AI-based robotic collection.

- Setting and selection of personal communication parameters;

- Support for a single interface to integrate with channels (communication module);

- Building analytical models for harder impact channels (notification of disconnection, auto-call and call before disconnection, claim work, collection software);

- Building multi-step and multi-channel strategies. Automatic selection of the optimal script and channel for the next step of the client communication;

- Automatic launch of communication channels / collection of responses from channels;

- Automatic updating of dashboards for analytics, reporting, communication and response processing;

- Formation of operational reporting on the communication efficiency by required metrics with data visualization (segments, strategies, channels).

Key benefits:

- Unified analytical center for managing AR collection;

- Formation of optimal strategies for interaction with debtors based on analytical recommendations:

- Increasing the share of debt collected;

- Increasing the share of successful communications;

- Increasing the first communication efficiency in monetary terms.

- Encouraging payment discipline and introducing pre-collection methods (sending SMS and IVM a few days before the scheduled payment);

- Scaling the solution to all channels of influence;

- Wide functionality of the system: from supporting all available communication channels, generating various predictive models and optimizing the AR collection to visualizing reporting in real time;

- Built-in processes of multi-channel communications with debtors, providing an assessment of impacts real cost and these impacts efficiency for collecting AR;

- Reducing the customer communication cost;

- Developing cross-selling for additional services / products;

- Increasing the amount of AR collected;

- Reducing the cost of collecting AR by using the optimal combination of offers and channels for individual clients, given business constraints, channel bandwidth and allowable budget;

- Building a transparent reporting system for users with an intuitive interactive web interface for a better understanding of the AR working results powered by commercial analytical platform;

- Developing a collection strategy depending on the client segment, the likelihood of collection and the collection tools application efficiency. Development of recommendations for optimizing collection tools, within existing Russian legislative and policy frameworks.